Apply for EU Settled Status Scheme

This is a complete guide on how to apply for the EU Settled Status Scheme. Find out who it applies to and the difference between pre settle status and settle status. In 2016 the UK voted to leave the EU via a referendum. As a result the benefits associated with being in the EU are due to be changed. One such benefit was the Freedom of Movement between EU members. If you intend on staying in the UK past the 21st of June 2021 you will need to apply for the settle scheme. The application is available now and it is free to apply. The HMRC initially charged for the application and then withdrew the charge due to complaints. If you did end up paying a fee then you will be refunded by the HMRC. If you plan on staying in the UK to work you will need to apply for a National Insurance Number.

You will get a “settle status” if your application is successful. Currently the deadline to apply is on June the 21st 2021 so you will need to apply before this date.

- Who can apply for a EU Settle Scheme

- Who does not need to apply for EU Settle Status

- What will happen after you have applied

- How to apply for EU settled status

- Documentation after your successful application

Who can apply for a EU Settle Scheme

Below is a list of situations of when you should apply for EU Settled Status Scheme. If you are affected by the end of free movement then a good rule of thumb to follow is to apply for EU Settled Status. The application was set up to ensure EU citizens and EU citizens family members rights after Brexit.

- You are a EU, EEA or Swiss Citizen

- Your family member is a EU, EEA or Swiss Citizen. You will still need to apply even if your family members from these countries are not required to, for example they already have Duel UK Nationality or already have a permanent residence rights.

- Anyone born in the UK but are not officially a British Citizen

- If you have a British Citizen spouse that lives with you outside the UK.

- You are the legal guardian or carer of a British Citizen

- If you previously had a family member or a EU member state, for example separated or deceased.

Who does not need to apply for EU Settle Statues

If any of the following situations apply then you don’t have to apply for EU Settled Status Scheme. If you are in any doubt at all or you can’t find a situation you belong to then we recommend contacting the HMRC for further guidance.

- You have an “indefinite leave to enter the UK” or an “Indefinite leave to remain in the UK”. These are types or UK permanent residence VISAs so the end of free movement won’t affect you.

- You have UK or Irish Citizenship. This includes if you have Dual Nationality, for example you have French and Irish Citizenship.

- If you where in the UK before the UK even joined the EU in 1969. If you joined before you should already have an “Indefinite leave to remain” status. You can find this out by looking for a stamp in your passport or you have a letter from the home office. If you do not have either (for example you have misplaced them) then it would be wise to get a replacement by phoning the home office. The home office number is 020 7035 4848.

- You are classed as a “Frontier Worker”. A frontier worker is someone who works in the UK but lives elsewhere.

- If you benefit from being “Exempt from immigration control”. If you have the exemption you are freely able to move in and out of the UK after Brexit. You are usually either a member of NATO or a foreign diplomat. If you stop being a exempt then you will need to apply for the settle scheme within 90 days.

What will happen after you have applied

There are currently 2 statuses. You will either be given Pre-settle or Settle Status. Which one you are given depends on a few conditions. They both basically give you the same rights and benefits of working and living in the UK. Settle status means you will have the same benefits as being a UK citizen for life, meaning you will be able to work and live in the UK for life. To get settle status you need to have lived in the UK for at least 5 years or arrive in the UK before 31st December 2020.

Pre-settle status is given if you haven’t yet lived in the UK for those 5 years or you arrive to the UK during the transition period. Once you have you lived in the UK for 5 years your status will change to “Settled”. Both once approved will enable you to continue living/working in the UK indefinitely, have access to the NHS, and have access to public funds and study in the UK.

Below are the conditions regarding living in the UK for 5 years.

- You will need to live in the UK for at least 6 months in any tax year continually for 5 years.

- Exceptions of when you can leave without braking the 5 years continuous living are illness, childbirth, overseas work posting, study and work training. This has a limit of up to 12 months.

Once you have settled status you are able to leave the UK for up to 5 years without loosing it. For pre-settled status you can leave for a period of 2 years without losing it, you will have to restart your 5-year continuous living if you leave over a period of 6 months.

If you give birth to a child while on a pre-settled or settle visa then your child will automatically be given British Citizenship.

How to apply for EU settled Scheme

It’s pretty easy to apply and shouldn’t take long at all. All you really have to do is supply a scan of your Passport, photo national ID or BRP card. An email address is also required. You can use your smartphone or laptop to begin the online application, which is available on the HMRC website now. They will ask a few questions and then send you an email with the application.

Website application can be found here – Click Here

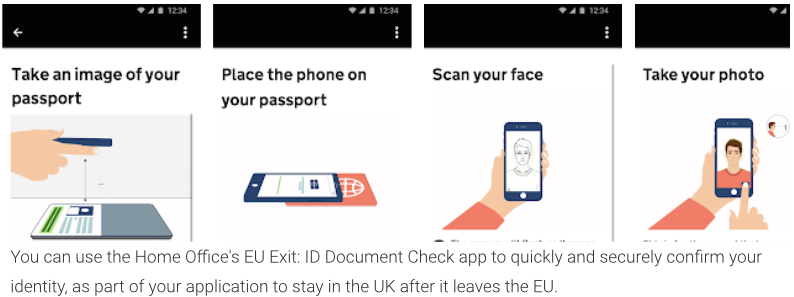

You will either have to scan and post your documents or use the “EU-Exit” android app. Unfortunately this app is only available to android smartphones. You would have thought an Apple iPhone app would have made more sense? And criminal convictions may result in an unsuccessful application. Minor offences such as speeding tickets will not harm your application.

If you don’t have a android phone you can visit your local HMRC application centre to use their document scanner.

HOW TO PROVIDE PROOF OF HOW LONG YOU HAVE LIVED IN THE UK

You will need to supply proof if you have lived continually lived in the UK for 5 years. Below are a few documents you can supply in order to prove this. You will not be able to use photos and videos as proof. The HMRC will work with you and help if you struggle to find evidence.

- Supply your National Insurance Number. Your National Insurance Number records the work positions and UK tax you have paid during your time in the UK, this will prove to the HMRC how long you have been in the UK.

- Rental contracts, mortgage payments.

- Council tax bills

- Invoices from student halls, schools and education centres. If you do not pay then a document showing the date you enrolled or passed the course.

- P45 or P60 work documents showing length of employment.

- Bank statements showing work income.

- Letter from employer

- Payslips

- Domestic bills

- Used travel tickets or documents showing the date you last entered the UK, for example passport stamps.

- Dated Invoice from self-employed work you have carried out in the UK with payment.

What documentation will i get after a successful application?

After a successful EU settled status application you will be send a email from the HMRC to confirm your status. The HMRC won’t issue you any physical or tangible document. Within the email will be a link and reference number where you can view your status. It’s important to keep your personal information up to date. The HMRC will need to be informed about any change as soon as possible.

If your application is unsuccessful you can appeal the decision here.