National Insurance Contributions

National Insurance contributions (NIC) are a mandatory tax in the UK. The payments you make go towards your state pension and other benefits when you require help. These other benefits include sickness payments, unemployment benefits or death. Your national insurance number will hold a record of all your payments.

- What are the National Insurance rates?

- What are the benefits of paying National Insurance contributions?

- National Insurance Format

- What are voluntary National Insurance contributions?

- How many years do I have to pay National Insurance to achieve a full state pension?

- How do I check gaps in my National Insurance records?

Everyone who is over the age of 16 will have to pay NIC. You only start paying once your income has reached a certain amount. If your employed you will have to pay Class 1. You only start paying when you earn over £162.00 a week (18-19 tax year). These payments will be taken automatically from your paycheck through PAYE.

If your self-employed you will need to pay Class 2 & 4. You start paying Class 2 NIC when you earn over £6,205. Class 4 is payable when you earn over £8,424 (18-19). If you earn under the Class 2 threshold you do not have to pay any NIC. These thresholds of £6,205 & £8,424 are on profit and not turnover. The payments are made when you fill in your self-assessment at the end of the tax year so make sure you put the money aside for them. Unfortunately NIC aren’t tax deductible for either self-employed or employed.

There is something called National Insurance Credits. You can claim these if you are unable to pay NIC due to illness or your currently caring for someone. These credits ensure there are no gaps in your record. Its important to contact the HMRC as soon as possible if you want to make a claim.

What are the National Insurance rates?

Class 1 (Employed) – You pay 12% on earnings between £162 and £892 a week (£702 to £3,863 a month). If you earn over 892 a week (£3,863 a month) there is an additional 2% on anything over this amount. Payments are taken automatically from your paycheck.

Class 2 & 4 (Self-Employed) – Class 2 NIC are £2.95 a week. You will have to pay class 4 NIC of 9% on profits between £8,424 and £46,350 then 2% on all your profits over £46,350. Payments are made when you fill in and pay your self-assessment end of year tax return.

Property or landowners – Different rules apply to property and landowners. If you fall into this category you will need to pay Class 2 of £2.95 a week if you earn over £5,965 a year. You do not have to pay class 4. If your profits are under this amount you can still make voluntary payments.

Class 3 – Class 3 payments are voluntary and you decide the amount you pay. You can pay class 3 to ensure you get a full state pension and other benefits.

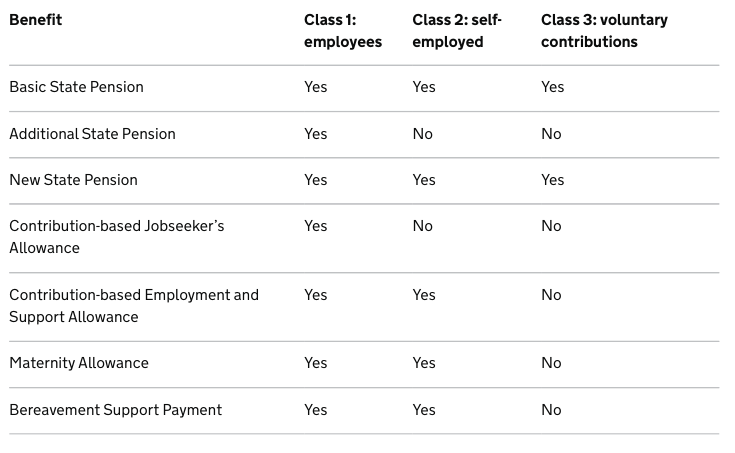

What are the benefits of paying NIC?

Please see the table below for all the benefits associated with different NI classes. The amount of benefits you are entitled to will depend on your NI record. Any gaps will affect your benefit amount and type.

National Insurance Format

National Insurance number starts with 2 letters followed by 6 numbers and are finished off with a letter (A-D). An example of a NI number is AB123456D. Isle of Man NI numbers will always start with the prefix MA. From 2011 the HMRC no longer issue cards and where replaced with an official letter.

What are voluntary NIC?

You can still pay National Insurance contributions even if your not working or leave the UK. You may want to continue to pay in order to achieve full state pension. In order to pay voluntary contributions you must comply with one of the following

- You have lived in the UK continually for 3 years before the period for which NIC is to be paid.

- Before leaving the UK you paid a set amount in National Insurance Contributions for 3 years or more.

You can pay Voluntary class 2 National Insurance contributions if you are employed or self-employed outside of the UK. Class 2 NI is cheaper than class 3 and comes with all the benefits.

You can sign into your Government Gateway account to see gaps and voluntary fill these gaps.

How do I check gaps in my National Insurance records?

To check your NI contribution record you will need a Government Gateway account. It’s easy to sign up and can be done online. Once your account is activated you can view your entire NI contribution record. You can see any gaps and make voluntary payments to fill them if you wish.

How many years do I have to pay NIC to achieve a full state pension?

To get the full benefit of state pension you must have at least 35 full years of National insurance contribution payments. You can benefit from a proportion state pension if you have between 10 & 35 years. All years must be qualifying and full payments made.